Key Takeaways

- The average payday loan interest rate in 2025 is 391%

- A typical two-week payday loan charging $15 per $100 has an annual percentage rate (APR) of approximately 391%.

- A typical payday loan charges about $15 per $100 borrowed, which annualizes to an extremely high APR that strains budgets.

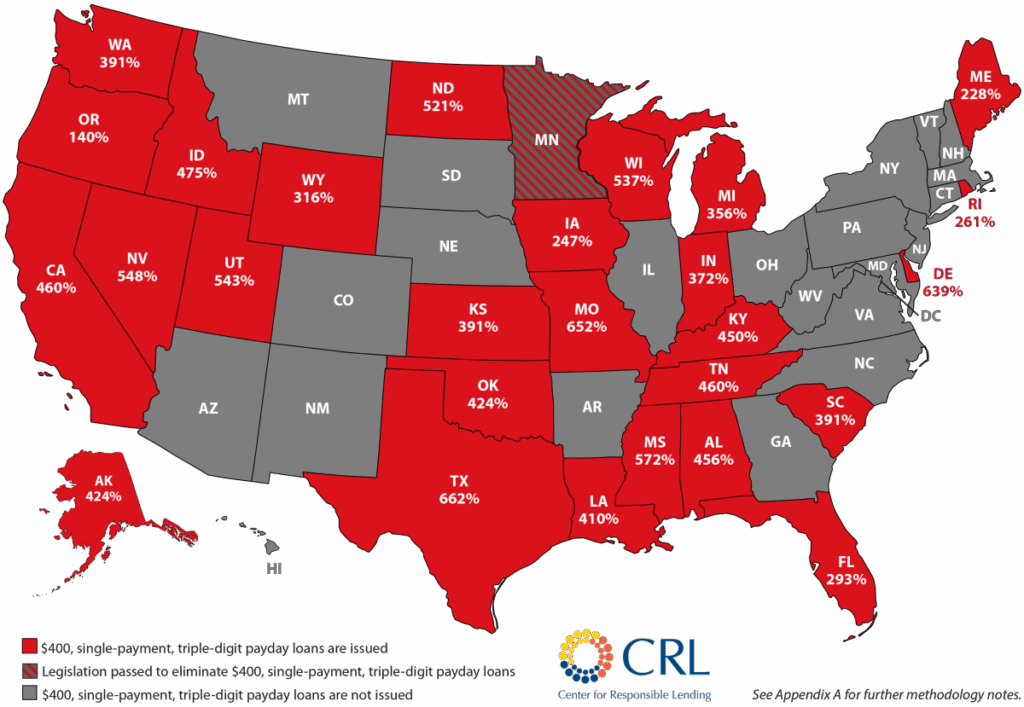

- In states without APR caps, payday loan rates can top 600%, while 36% cap states cut costs or eliminate payday lending.

- Credit union Payday Alternative Loans (PALs) cap APRs at 28%, offering a far cheaper option than payday loans with rates over 300%.

The average payday loan interest rate in 2025 is 391%. Payday loans are designed to be small, short-term cash advances, usually a few hundred dollars, that are due on your next payday, and they carry heavy fees that, when annualized, create those sky-high average annual percentage rate (APR) numbers.

The Consumer Financial Protection Bureau (CFPB) monitors and regulates payday lending practices and has recently finalized protections aimed at limiting some of the most harmful collection practices (with key parts of the rule taking effect in 2025).

A typical payday loan borrower uses payday loans for urgent expenses, such as car repairs, unexpected medical bills, or a financial emergency before payday. However, the steep costs and common rollovers can trap borrowers in a cycle of repeated borrowing and escalating fees. Consumer research and advocacy groups warn that these products often cost significantly more than alternative small-dollar options.

What Are Payday Loans?

A payday loan is a small, short-term loan typically $500 or less designed to be repaid in full within a few weeks, usually on the borrower’s next payday. To get a payday loan, payday lenders almost always require borrowers to have a bank account, since repayment is often made through an electronic withdrawal on the due date.

Loan amounts from payday lenders and interest rates vary widely by state. Some states set strict caps, such as 36% APR, while others permit much higher rates that can exceed 300% to 600% APR. In addition to interest, payday loans carry finance charges that usually range from $10 to $30 per $100 borrowed, which can make the total cost far higher than many borrowers expect.

What Are the Payday Loan Interest Rates By State in 2025?

| State / DC | Classification | Note |

| Alabama | Less strict | Allows very high short-term APRs; no effective 36% cap. |

| Alaska | Strict | State APR cap for small loans at or below 36%. |

| Arizona | Less strict | Permits high-cost payday lending (no effective 36% cap). |

| Arkansas | Strict | Low APR caps that effectively block storefront payday lending. |

| California | Less strict | Payday-style products are available with relatively high APR ceilings. |

| Colorado | Less strict | Reforms have limited abuses, but still allow higher APRs than 36% for some products. |

| Connecticut | Strict | Strong restrictions that make traditional payday loans largely unavailable. |

| Delaware | Less strict | No statutory 36% cap (higher allowable rates or special rules). |

| Florida | Less strict | Allows high short-term APRs under state law. |

| Georgia | Less strict | Payday-style lending tightly restricted for small amounts but higher-cost products exist. |

| Hawaii | Strict | Caps limit payday-style lending (≈36% or lower effective cap). |

| Idaho | Less strict | Very high allowable rates / weak cap (effectively permissive). |

| Illinois | Less strict | Recent reforms tightened rules, but still no universal 36% cap for all small loans. |

| Indiana | Less strict | Permits high short-term APRs; not in the ≤36% group. |

| Iowa | Strict | Statutory cap at or near 36% for small closed-end loans. |

| Kansas | Less strict | Allows high short-term APRs. |

| Kentucky | Less strict | Permits high APRs for short-term loans. |

| Louisiana | Less strict | High allowable APRs for short-term payday-style loans. |

| Maine | Strict | Interest limits that fall at or below the 36% benchmark for small loans. |

| Maryland | Strict | State caps that effectively prohibit high-cost payday storefront loans. |

| Massachusetts | Less strict | Strong restrictions on payday-style products (treated as strict in some analyses), but for this table, treated outside the ≤36% list. |

| Michigan | Less strict | Higher allowable APRs for short-term products. |

| Minnesota | Less strict | Recent reforms (2024) tightened rules — but still not classified here as a universal ≤36% cap for all product sizes. |

| Mississippi | Less strict | Allows very high APRs under certain laws. |

| Missouri | Less strict | No effective cap; permissive. |

| Montana | Strict | Caps that put it at or below the 36% threshold for small loans. |

| Nebraska | Less strict | Higher allowable APRs than the 36% benchmark for many loans. |

| Nevada | Less strict | Allows relatively high APRs for short-term loans. |

| New Hampshire | Strict | 36% (or similar) cap applies to many small closed-end loans. |

| New Jersey | Strict | Strong rate limits (≤36% in many cases). |

| New Mexico | Less strict | Historically high caps reduced by reform in recent years, still not universally ≤36% for all small loans. |

| New York | Strict | Criminal usury limits and caps make high-cost payday storefront lending effectively unavailable. |

| North Carolina | Strict | Low statutory caps for many small loans (well under 36% for relevant products). |

| North Dakota | Strict | 36% (or lower) statutory cap for non-bank consumer loans. |

| Ohio | Less strict | Multiple laws with varying caps; allowed APRs above 36% for some short loans. |

| Oklahoma | Less strict | Permits very high APRs in some lending categories. |

| Oregon | Strict | Caps that put certain small loans at or below 36%. |

| Pennsylvania | Strict | Strong statutory limits that effectively bar traditional payday storefront loans. |

| Rhode Island | Strict | Small-loan caps at or below the 36% marker for many products. |

| South Carolina | Less strict | Permits high APRs for short-term loans. |

| South Dakota | Strict | State caps that meet the ≤36% benchmark for small loans. |

| Tennessee | Less strict | Very high allowed APRs for short-term lending. |

| Texas | Less strict | High permitted APRs for certain small loans (no universal 36% cap). |

| Utah | Less strict | Weak/wide statutory standards (unconscionability) rather than a tight 36% cap. |

| Vermont | Strict | Low APR limits (≤36% for the small-loan examples). |

| Virginia | Strict | Caps put many small loans at/under 36%. |

| Washington | Less strict | Allows relatively high APRs for some product types. |

| West Virginia | Less strict | Various limits exist, but still permissive compared with 36% cap states. |

| Wisconsin | Less strict | No bright-line cap (unconscionability standard); classified as less strict here. |

| Wyoming | Strict | State caps that meet the ≤36% benchmark. |

| District of Columbia | Strict | Caps and rules that prevent high-cost storefront payday lending. |

What Are The Current Average Payday Loan Interest Rates in the US?

There isn’t one single “average” APR you can point to; payday loan APRs typically fall in a very high range (roughly 300%–600% APR), depending on the fee structure and state rules. A common pricing example helps explain why: a $15 fee per $100 on a typical two-week payday loan annualizes to about 391% APR. That $15-per-$100 example is widely used by regulators and researchers to illustrate how small short-term fees turn into high-cost payday lending annual rates.

Rates differ dramatically by state and by loan structure. In some states, payday loans are effectively capped (many jurisdictions use a 36% APR ceiling or ban payday-style loans entirely), while other states allow single-payment loans with reported average APRs well over 500%. For example, Pew found an average APR of 652% for a single-payment $500 payday loan in Idaho.

Quick Facts About Payday Loan Fees:

- Typical fee range from payday lenders: $10–$30 per $100 borrowed (varies by state).

- Common shown APR for $15/$100 (14-day loan): ≈391% APR.

- Some state averages and single-payment loans can exceed 500–600% APR.

How Do Payday Loan Interest Rates Work in 2025?

In 2025, payday lenders’ interest rates work by converting a short-term, flat fee into an annual percentage rate (APR) so the true cost can be compared to other loans. In practice, lenders charge a flat finance fee (for example, $15 per $100 borrowed) for a two- to four-week loan, and that one-time fee, when annualized, becomes the very high APR numbers people see.

How Payday Loan Interest Works

If you’re interested in acquiring payday loans, it is important to understand how they’re calculated. Before borrowing money, you should always be aware of the potential drawbacks to avoid predatory lending practices. Below is an example of a payday lending calculation.

- The lender charges a flat fee.

– Example: $15 fee for each $100 borrowed on a typical two-week (14-day) payday loan. - Compute the fee as a fraction of the principal.

– Fee / Loan amount = 15 ÷ 100 = 0.15 (this is the portion of the loan charged for the term). - Annualize the short-term fee to get the APR.

– Formula (simple annualization): - APR (%) = (Fee ÷ Loan Amount) × (365 ÷ Loan Term in days) × 100

– Using the example:

- 365 ÷ 14 = 26.0714285714

- 0.15 × 26.0714285714 = 3.91071428571

- 3.91071428571 × 100 = 391.071428571% → ≈ 391.07% APR

What Is My State’s Payday Loans Interest Rate?

State laws and regulations governing payday lending vary widely; some states cap short-term loan APRs at around 36%, while others permit much higher average interest rates or allow storefront and online payday products to operate with few limits.

A number of jurisdictions have moved to protect consumers: the District of Columbia and several states have adopted strict caps or outright bans on certain payday products, and a few states (and courts) have taken actions that effectively bar high-cost deferred-presentment loans.

Lenders must follow state rules on disclosure, licensing, and rate limits, and many states require clear fee disclosures and licensing for payday lenders to operate legally. The CFPB also enforces federal payday-lending rules that affect payment of consumer loans.

Quick Facts About State Regulations

- Wide variation across states: Some states allow APRs well above 600%, while others enforce caps as low as 36%, showing how borrowers’ cost experiences differ drastically depending on local regulations.

- Regulatory gaps persist: Over half of the U.S. still permits high-interest rates for payday loans, highlighting the need for stronger consumer protections.

- Effectiveness of rate caps: States enforcing caps (e.g., 36% APR) significantly reduce payday loan costs and help prevent debt traps—further underscoring the importance of legal safeguards.

What Are the Factors That Affect Payday Loan Interest Rates?

The main factors that affect payday loan interest rates are state laws and rate caps, lender type, loan amount, repayment term, and possible additional fees set by payday lenders. State regulations are the most influential in states with strict APR caps (such as 36%), where payday loans are much cheaper or unavailable, while in states without caps, APRs can exceed 600%. Lender type also matters: storefront, online, and fintech payday lenders each have different cost structures that influence pricing.

Loan size and term length play a role, too; smaller loans and shorter terms can produce higher effective APRs, while longer repayment periods spread out costs. Other influences include whether the loan is single-payment or installment-based, and extra costs such as rollovers, late fees, or insufficient funds charges.

Knowing these factors helps borrowers with responsible lending so they can compare offers more accurately and anticipate the true cost and other financial obligations beyond just the advertised APR.

Factors At a Glance

- State laws drive costs most: APRs can be capped at 36% in strict states or exceed 600% where no caps exist.

- Loan size, term, and type matter: Smaller, short-term, or single-payment loans often lead to higher effective APRs.

- Extra fees add up: Rollovers, late fees, and NSF charges can make payday loans far more expensive than the advertised APR.

What Are The Risks Involved With a Payday Loan?

The risks involved with payday loans include extremely high costs, short repayment windows, and a high likelihood of falling into a cycle of debt. Because these loans often come with triple-digit APRs and fees that compound quickly, many borrowers struggle to repay on time — leading to rollovers, additional fees, and mounting debt.

| Risk | Description |

| High APR | Rates often exceed 300%–600%, making loans very expensive. |

| Short Repayment Period | Typically due in 2–4 weeks, leaving little time to gather funds. |

| Debt Cycle | Rollovers and renewals can trap borrowers in long-term debt. |

| Bank Account Access | Lenders often withdraw payments automatically, risking overdraft fees. |

| Negative Credit Impact | Missed payments may be sent to collections, hurting credit scores. |

Are There Alternatives To Payday Loans?

Alternatives to payday loans include credit union small-dollar loans, personal installment loans, payment plans with creditors, and assistance programs from nonprofits or government agencies. These options typically offer lower interest rates, longer repayment terms, and fewer risks than payday loans.

Credit unions, for example, may offer Payday Alternative Loans (PALs) with APRs capped at 28%, while some national banks and online lenders provide short-term personal loans with more manageable terms. Borrowers can also negotiate payment extensions or hardship plans with utility companies, landlords, or service providers.

Other resources include nonprofit credit counseling agencies, local charities, and state emergency assistance programs, which can help cover urgent expenses without the high costs of payday lending. Exploring these alternatives can save hundreds of dollars in fees and help avoid the debt traps associated with high-cost short-term loans.

Next Steps To Take

Payday loans offer quick cash but come with steep costs, often 300%–600% APR, and short repayment terms. To avoid the debt trap, explore safer alternatives like credit union small-dollar loans, personal installment loans, or assistance programs. If you must use a payday loan, know your state’s regulations, compare rates, and plan repayment carefully. Being informed is the best way to protect your finances.

Sources:

- https://www.pew.org/-/media/assets/2022/04/payday-loans-cost-4-times-more-in-states-with-few-consumer-protections.pdf?

- https://www.stlouisfed.org/open-vault/2019/july/how-payday-loans-work?

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567

- https://www.consumerfinance.gov/about-us/blog/weve-proposed-rule-protect-consumers-payday-debt-traps

- https://files.consumerfinance.gov/f/documents/Supplemental_Report_060116.pdf

- https://www.consumerfinance.gov/compliance/compliance-resources/consumer-lending-resources/payday-lending-rule/payday-lending-rule-faqs

- https://www.pew.org/en/research-and-analysis/issue-briefs/2022/04/payday-loans-cost-4-times-more-in-states-with-few-consumer-protections

- https://www.ncsl.org/financial-services/payday-lending-state-statutes?utm_source=chatgpt.com

- https://www.consumerfinance.gov/compliance/compliance-resources/consumer-lending-resources/payday-lending-rule/payday-lending-rule-faqs

- https://www.responsiblelending.org/media/new-crl-map-shows-excessive-payday-lending-interest-rates-still-plague-over-half-us-states

- https://www.responsiblelending.org/media/new-crl-map-shows-excessive-payday-lending-interest-rates-still-plague-over-half-us-states

- https://www.nclc.org/wp-content/uploads/2024/10/202501_Issue-Brief_Comparing-APRS-on-Small-Loan-Alternatives.pdf