They say money can’t buy happiness — but your financial health still has a huge impact on your overall well-being.

Your financial health affects every area of your life, including your physical and emotional health.

Are you curious about your Financial Health?

CreditNinja can help.

Read on to find out why your financial health is so important and how CreditNinja can give you the tools you need to put yourself on the path to a secure financial future.

Table of Contents

- What Is Financial Health

- Why Is Financial Health Important?

- 9 Financial Health Stats Everyone Should Know

- #1: 79 Million Americans Are in Debt

- #2: Over Half of Americans Spend More Than They Earn

- #3: Over 37% Reveal They Lack the Resources Needed to Cover a Month’s Expenses

- #4: A Quarter of All Americans Have No Retirement Savings

- #5: At Least 56% of Financially Unhealthy People Say It Has Negatively Impacted Their Life

- #6: One in Three Financially Unhealthy People Struggle With Anxiety and Depression

- #7: Financially Unhealthy People May Have Increased Physical Health Concerns

- #8: Over 33% of Financially Unhealthy People May Put off Getting Healthcare

- #9: At Least 74% of Financially Unhealthy People Have Trouble Sleeping

- Understanding Your Financial Health is Critical to Your Future Happiness — Let CreditNinja Help With Our Financial Health Survey

What Is Financial Health

Your financial health is the overview of the money that you manage in your life. It involves your income, expenses, savings, investments, and anything else that is related to your relationship with money.

Simply put, your level of financial health indicates your ability to pay for expected — and unexpected expenses — now and in the future.

Financial health has a variety of dimensions, including:

- The amount you have in your savings account

- Your level of your debt

- The manageability of your household debt

- Your ability to pay your bills on time

- The amount of insurance you have and what type of policies you carry

- How much money you are putting away for retirement

- How much of your income is being spent on non-discretionary or fixed expenses; and

- Your credit score

Why Is Financial Health Important?

Financial health is one of the key factors when it comes to living a happy life.

Poor financial health can negatively impact every area of your life, including your:

- Physical and mental health

- Social life

- Relationships; and

- Quality of sleep

9 Financial Health Stats Everyone Should Know

#1: 79 Million Americans Are in Debt

Whether it is …

- A home mortgage

- Student loans

- Car loans; or

- Credit card debt

… a whopping 79 million Americans carry some form of debt.

#2: Over Half of Americans Spend More Than They Earn

Does your money consistently run out before your next paycheck?

If so, you are not alone.

According to a joint research study by the Association of Young Americans (AYA) and the AARP, over 50% of us spend more than we earn.

- Nearly 50% have credit card debt

- Over 40% have a home mortgage or car loan; and

- Higher than 30% carry student loan debt

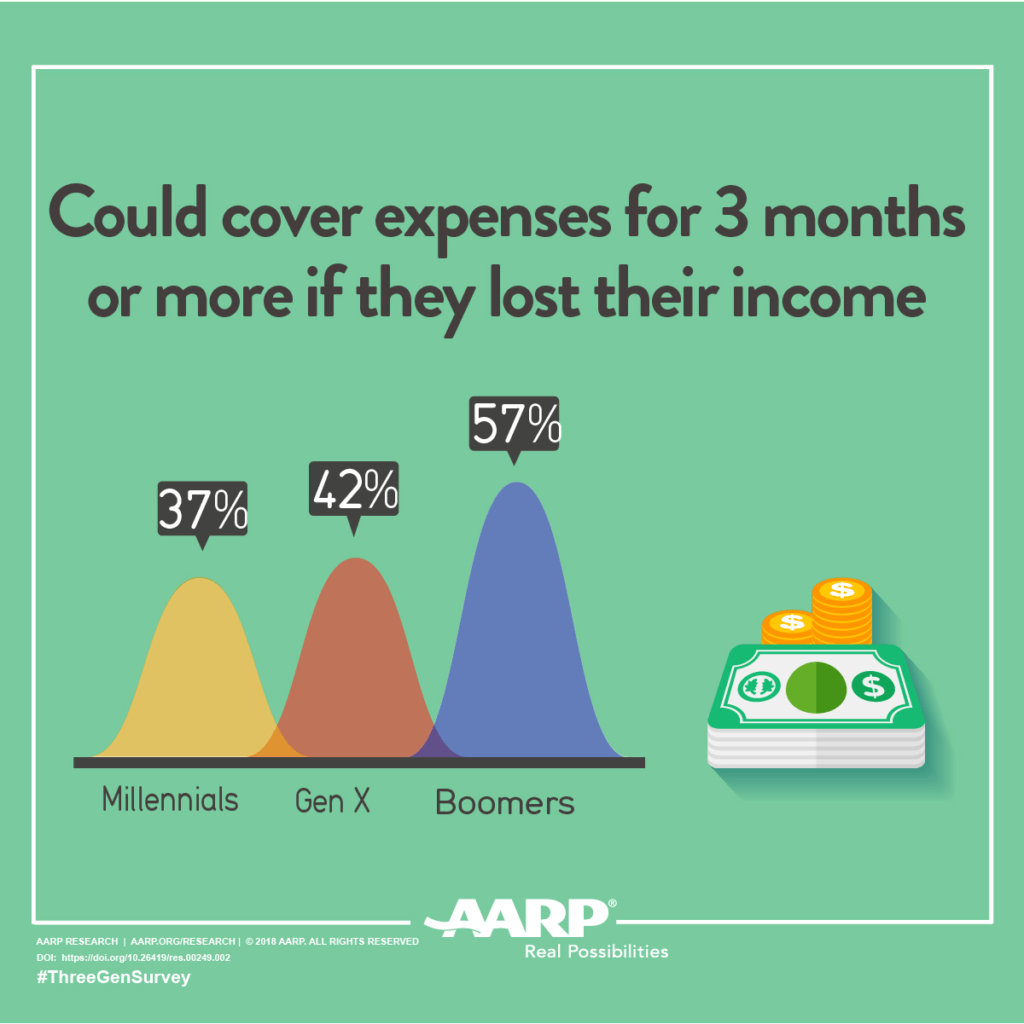

#3: Over 37% Reveal They Lack the Resources Needed to Cover a Month’s Expenses

Call it an “emergency fund” or money set aside for a “rainy day,” almost one-third of all Americans say they could not cover their expenses for a full month if they suddenly had no income to rely on.

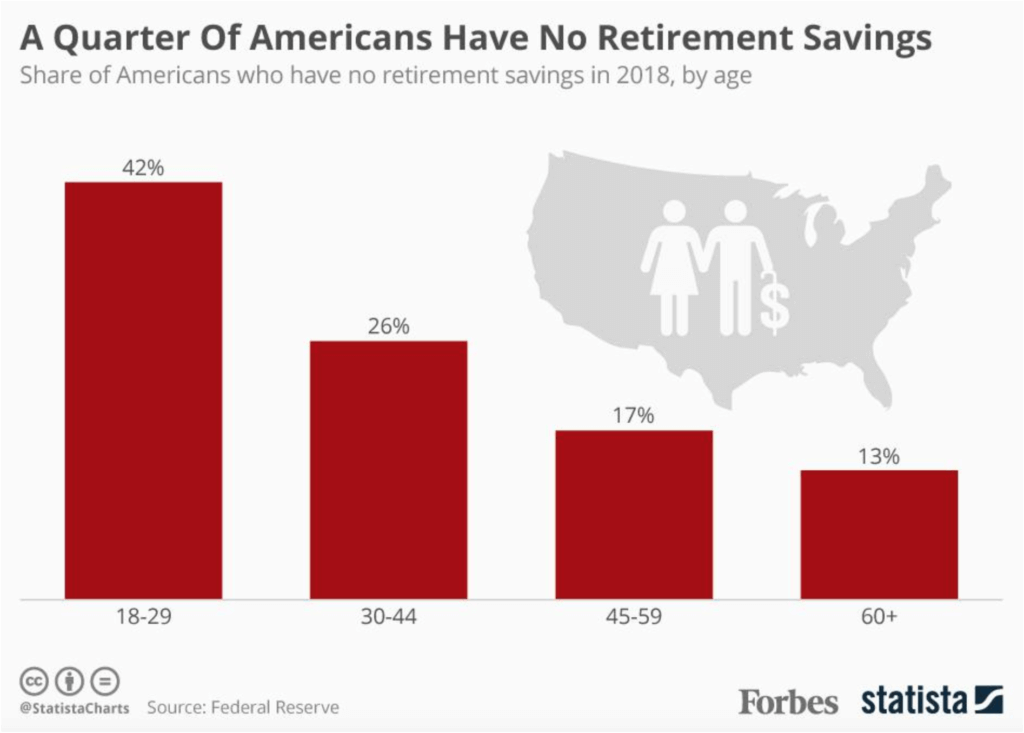

#4: A Quarter of All Americans Have No Retirement Savings

It turns out that Albert Einstein was spot-on when he said,

“Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.”

And nowhere does compound interest come more into play than in saving for retirement.

But sadly, according to a recent report by the US Federal Reserve, one-fourth of all Americans failed to plan ahead or invest and have nothing set aside for retirement.

And for those who do have retirement funds set aside, they often prove to be woefully inadequate.

A 2017 study by the Center for Retirement Research took a close-up look at retirement account balances by age groups, and here is what they found:

- Adults age 35-44 have an average IRA balance of $37,000

- Adults age 45-54 have an average IRA balance of $80,000

- Adults age 55-64 have an average IRA balance of $104,000

If American’s plan to retire by the average age of 64, their median of $104,000 will very likely not be enough to sustain them throughout retirement.

Retirement income calculator

By using our “When Can I Retire Calculator,” you can get a clear picture of how to successfully prepare for your future. Simply plug in the information needed on the calculator and let our experts do the work for you quickly and efficiently.

Your retirement story

I am years old, my pre-tax income is and I have current savings of . Every month I save ( of my monthly income). Investment rate of return is .

My retirement spending will be per month. I am expecting to retire when I am years old and my life expectancy is years.

How much will you need to retire at 0?

Based on the information you provided, when you retire at age 0, you may have a retirement savings balance of $0 (in today’s dollars). Your estimated monthly expenses are $0, and you could expect a monthly income of $0 in retirement.

Retirement Savings: $0

…

Preparing for the future is easy with resources like CreditNinja by your side.

#5: At Least 56% of Financially Unhealthy People Say It Has Negatively Impacted Their Life

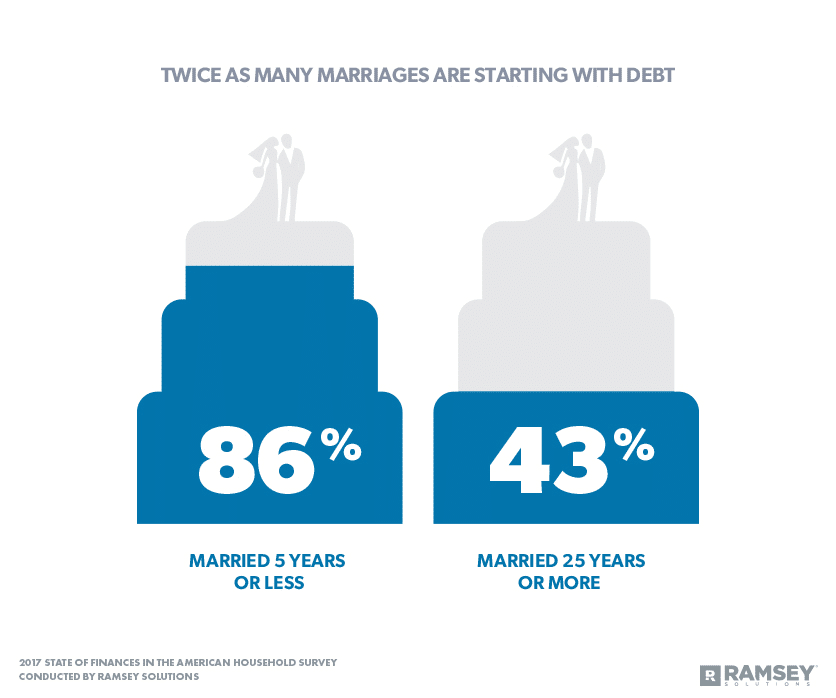

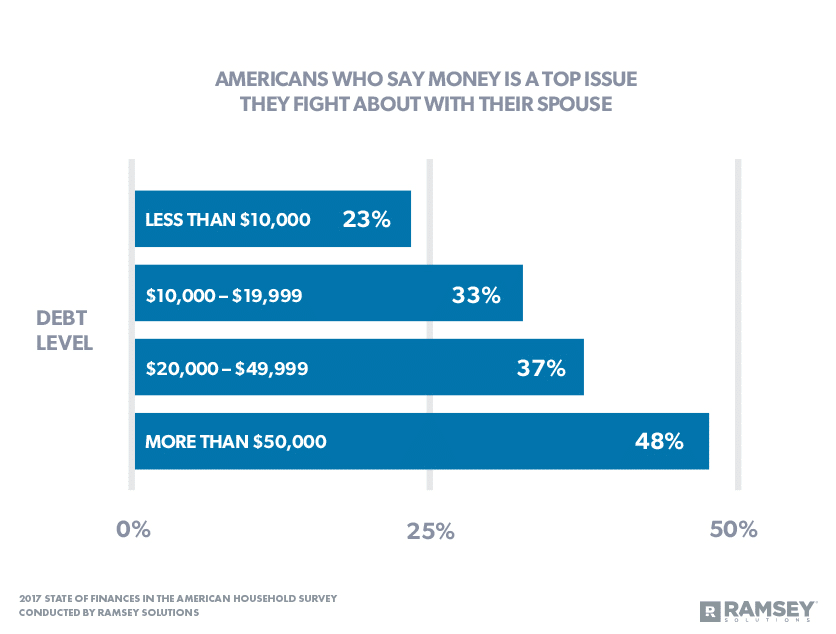

The lack of financial health is a major cause of relationship tension with a spouse or partner.

According to a 2017 survey by Ramsey Solutions, a leader in financial education, fights over money are the second leading cause of divorce.

Their survey also revealed that:

- 41% of couples with consumer debt say that not only is money a huge point of contention — it is the topic that they argue about the most

- Almost two-thirds of all marriages began in debt

- 43% of couples who have been married for over 25 years started their marriages in the red; while

- 86% of couples who have been married 5 years or less began their lives together in debt

#6: One in Three Financially Unhealthy People Struggle With Anxiety and Depression

People who are in debt are three times more likely to struggle with anxiety and/or depression.

Uncertainty over …

- How you will pay your bills each month

- Whether you will be able to take a vacation this year

- How you will afford to pay for new tires

- If there is extra money in the budget to go out to eat with friends; or

- If you have enough money set aside to retire when you had hoped

… puts tremendous amount of stress on your mental health.

#7: Financially Unhealthy People May Have Increased Physical Health Concerns

Does logging into your banking app make your stomach churn?

If so, you are not alone.

Research has shown that financial debt not only causes a higher incidence of anxiety and depression but that people who are in debt also suffer from:

- Higher diastolic blood pressure; and

- Worse general health, overall

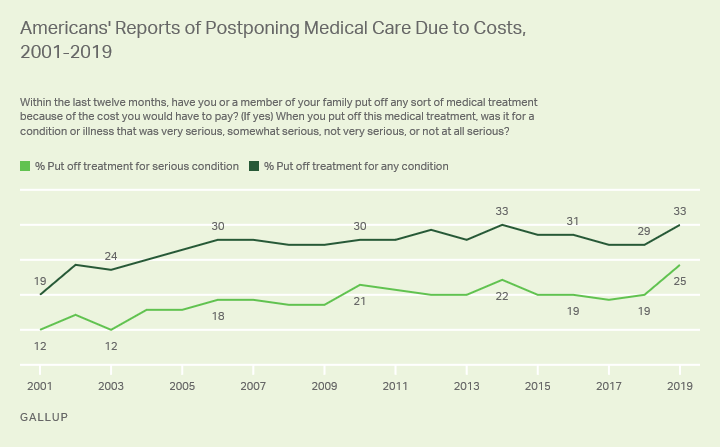

#8: Over 33% of Financially Unhealthy People May Put off Getting Healthcare

Since financially unhealthy individuals have less money in their budgets, they frequently delay seeking the health care they need.

The 2019 Gallup Health and Healthcare poll revealed that one-third of all individuals put off seeking treatment for a medical condition solely due to the cost they would have to pay.

#9: At Least 74% of Financially Unhealthy People Have Trouble Sleeping

Research suggests a strong correlation between being in debt and poor sleep and the use of sleep medication.

Understanding Your Financial Health is Critical to Your Future Happiness — Are you ready to find out how you can better manage your money?

CreditNinja has you covered!

At CreditNinja, we care about your financial health and well-being, and we have the financial resources you need to set yourself up for a happy and successful future.

Matt Mayerle is a Chicago-based Content Manager and writer focused on personal finance topics like budgeting, credit, and the subprime loan industry. Matt has a degree in Public Relations and has been researching and writing about financial literacy and personal finance since 2015, and writing professionally since 2011.