Pawn shops use factors like market value, resale value, current supply and demand of their local market, profit margin, and condition of the item to determine value.

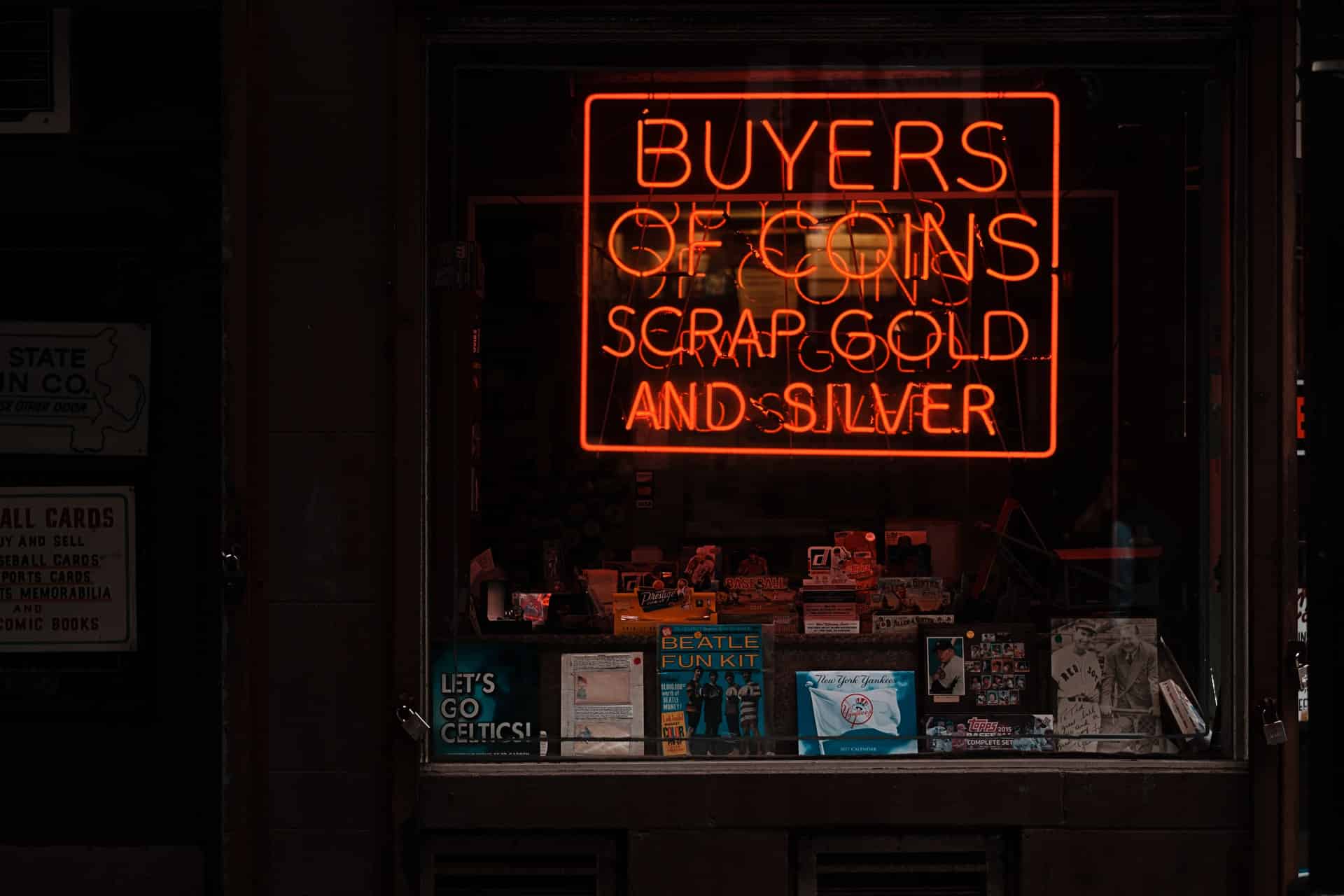

Pawn shops are businesses that loan money to customers when they bring valuable items used as collateral; they also buy things outright. Across the country, there are 8,531 pawn shops as of 2023.1 Some pawn shops specialize in certain items, such as gold jewelry; however, most pawn shops take a variety of items. When people need some extra cash, they may turn to these shops to get the money they need. If you are considering a pawn shop, you may be wondering how these shops determine value.

Below is everything you need to know about how pawn shops work.

More Details on How Pawn Shops Determine Value

There are many variables that pawn shops look at when figuring out how much they want to pay for an item a customer brings in. Although some customers repay their loans, pawn shops have to consider what happens when that is not the case.

And so the percentage of money that you will get is based on how much your item can sell for and the shop’s risk.

Here are some of the different factors that pawn shop owners/workers will look at:

| How Pawn Shops Determine Value: Factors | Description |

| Market Value | The current market value of an item is what a third party would pay to purchase it. |

| Resale Value | How much and how fast an item can sell for. |

| Evaluations | Evaluations, often used for fine jewelry and precious metals, factor in market and resale value to determine a loan amount. |

| Condition | Pawn shops assess the condition of your item, especially for electronics, to ensure they function correctly. Items in better condition will fetch a higher price. |

Below is more detail on each variable:

Market Value

The current market value of an item is the amount that a third party would pay to purchase it. Market value will significantly influence how much you will get when pawning an item. This variable can be a little confusing and sometimes frustrating if you are selling something, especially if you paid top dollar for it or if it has sentimental value. However, the reality is that most items will not be worth the amount that you paid, especially if you are planning to sell them to a pawn shop.

Resale Value

If you cannot repay your loan (called a default), the pawn shop will have to sell your item to make that money back. And so this value will be a huge factor when a pawn shop is determining the value of what you are selling. The ability to resell will encompass everything from how long an item will take to sell and for how much. Inventory is a huge component of running a pawn shop. And so, the longer an item takes to sell, the less space they have for other things that could be displayed, which is bad for business.

Evaluations

Evaluations are a considerable part of purchases that include fine jewelry (such as an engagement ring) or precious metals (gold, silver, bronze) but can also apply to other items. Pawn shops will factor in market and resale value to come up with a loan amount they feel comfortable giving out. When discussing evaluations, you may also hear about appraisals. Appraisals will provide the value of an item, but they do not take into account demand and details of market value.

And so, although your item may be appraised at one amount, that does not mean you will get that amount when you go to pawn or sell your item.

Condition of Your Item

Lastly, pawn shops will pay attention to the condition of your item. When it comes to electronics, they will need to know that everything is working as it should. With other items like musical instruments, jewelry, and art, they will check to see the overall condition by checking for things like scratches, dents, stains, etc.

Pawn Shops Determine Value With Different Tools

There are a few different tools that most pawn shop employees will use when figuring out the value of an item. Here are some of them:

Different Value Databases and Research Tools

There are kinds of databases online that can help buyers figure out what an item is worth. Although less popular nowadays, some pawn shop owners may also use books specializing in different objects to figure out the value of an item. One example of an online database is Kelley Blue Book. Buyers and sellers of cars often look at Kelley Blue Book to figure out the current market price.

Specialists and Experts

Pawn shops buy all kinds of things, and some things are more challenging to research than others. For example, antiques, watches, art, and collectibles can be difficult for a pawn broker to determine value. And so, pawn shops will consult experts in different fields to figure out a value and potential profit margin for the item. For example, they may go to an engagement ring expert if you bring in a diamond ring. Sometimes that specialist may be working in the store or be a third party.

Pawn Shops Determine Value Based on Sales History

Another easy way that a pawnbroker determines the current market value of an item is to see a recent selling price. Most of the time, this is through sites like eBay. Sales history gives a pawn shop a good idea of how quickly and for how much an item will sell. From here, pawn shops pay what they think is fair.

Experience and Knowledge

Another tool that pawn brokers will use is their experience and knowledge. If a pawn shop has been in business for many years, chances are that they have a good idea of an item’s value. They have experience on what things sell for more money and how quickly versus things that will sit in their shop for a while and mean less money.

Should I Sell or Pawn an Item?

When visiting a pawn shop, you will have two choices; either sell an item altogether or have it put on hold until you pay your loan back. When you sell an item outright, you may get more money for it than a pawn shop loan. However, it may not be a huge difference, and if your item has sentimental value, you may not want to sell it.

Alternatives to Pawn Shops

Pawn shops aren’t suitable for everyone when they need quick cash. The good news is there are alternatives. Here are a few loan options to consider that offer quick cash:

Personal Loans

Standard personal loan options are unsecured loans that are repaid in regular installments. The interest rates and repayment terms will be based on your financial situation and the lender you choose to work with. The great thing about these loans is that they are available for borrowers with bad credit. Loan amounts can range between a few hundred dollars and a few thousand. When working with online lenders, you can expect a speedy process.

Payday Loans

Payday loans use the borrower’s paycheck to secure funding. You can find a payday loan online or find one through an in-person lender. These loans are short-term loan options for a few hundred dollars. You can get a payday loan with bad credit; however, these loans come with high-interest rates and fees, leading to a cycle of debt.

Car Title Loans

Car title loans use a borrower’s vehicle as collateral. The loan amount will be based on the value of your car and income rather than your credit score. Like payday loans, they come with extremely high-interest rates and fees. There is also the possibility of losing your vehicle if you cannot pay back the loan.

Cash Advances

You can get a cash advance through a loan or a credit card. Cash advance options are usually fast but are only available for a few hundred dollars. On top of that, you may be paying a lot in interest for a small amount of funding.

FAQS: How Do Pawn Shops Determine Value?

Pawn shops often work closely with local law enforcement and maintain a database of items they accept. They typically require customers to provide valid identification and may take photographs of the items and the seller. This information can be cross-referenced with reported stolen items to prevent illegal transactions.

Once you’ve pawned an item and agreed on a loan amount, any subsequent increase in the item’s market value won’t affect your loan terms. You’ll still be required to repay the original loan amount plus any interest and fees to reclaim your item.

Yes, many pawn shops are open to negotiation. If you believe your item is worth more than the initial offer, presenting evidence of its value or explaining its significance can help you get a better deal.

Pawn shops usually have a set period, often 30 to 90 days, during which the borrower can repay the loan and reclaim their item. If the loan isn’t repaid within this period, the pawn shop has the right to sell the item to recover their money.

While pawn shops accept a wide range of items, jewelry such as an engagement ring, instruments, collectibles, etc., they may refuse items that are challenging to resell, outdated, or in poor condition.

The Bottom Line With CreditNinja: How Do Pawn Shops Determine Value?

If you are considering a pawn shop, you may be wondering how pawn shops determine value. When you go to pawn something, a pawn shop will look at several factors like market value, condition, and resale value to determine how much they want to lend. CreditNinja wants you to know that you never have to accept their offer if you don’t want to, and there are alternatives.

References: